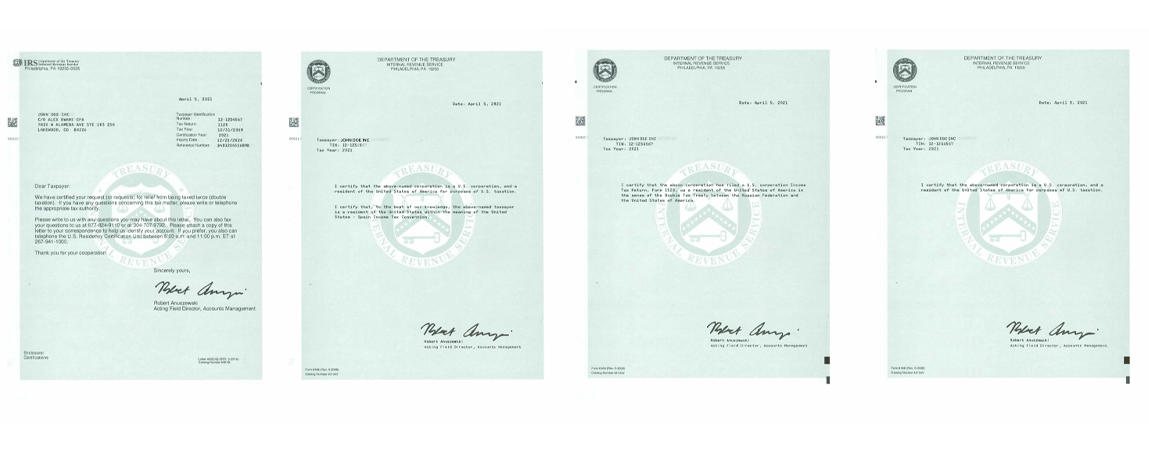

Claim Tax Treaty, Avoid Double Taxation and Request VAT Exemption – Form 6166 – Certification of U.S. Tax Residency - O&G Tax and Accounting

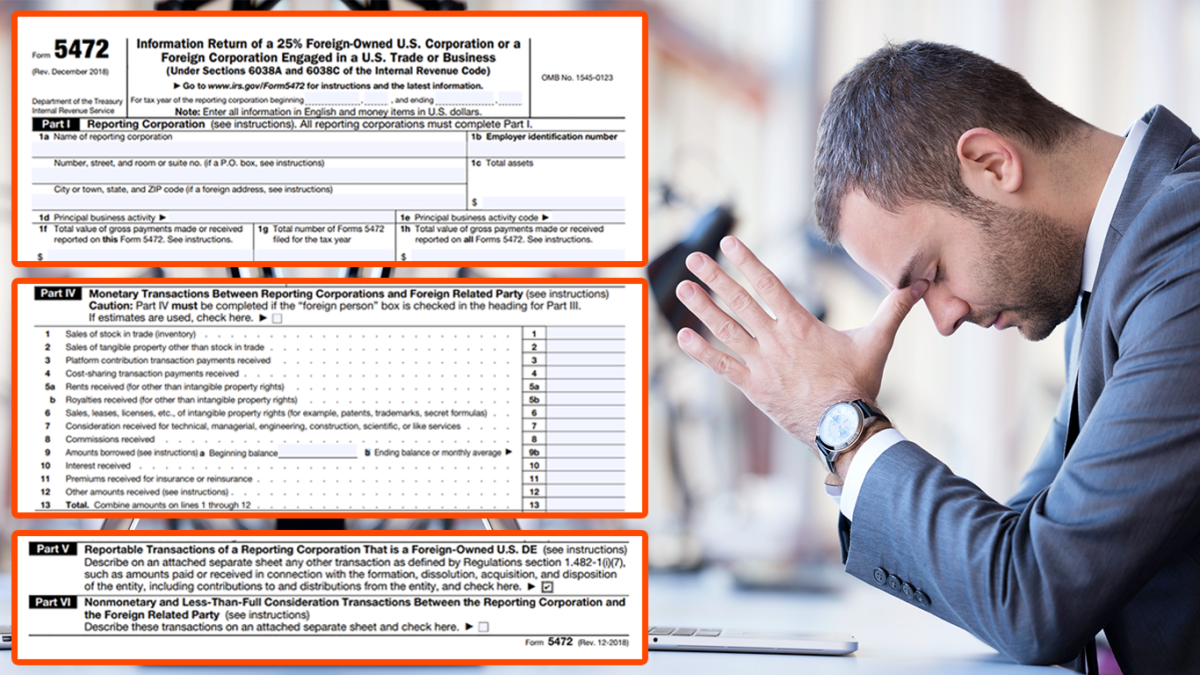

Forms and Filing for Foreign-Owned U.S Multi-Member LLC | Exploring a Case of an Australian-Owned U.S. Partnership - O&G Tax and Accounting